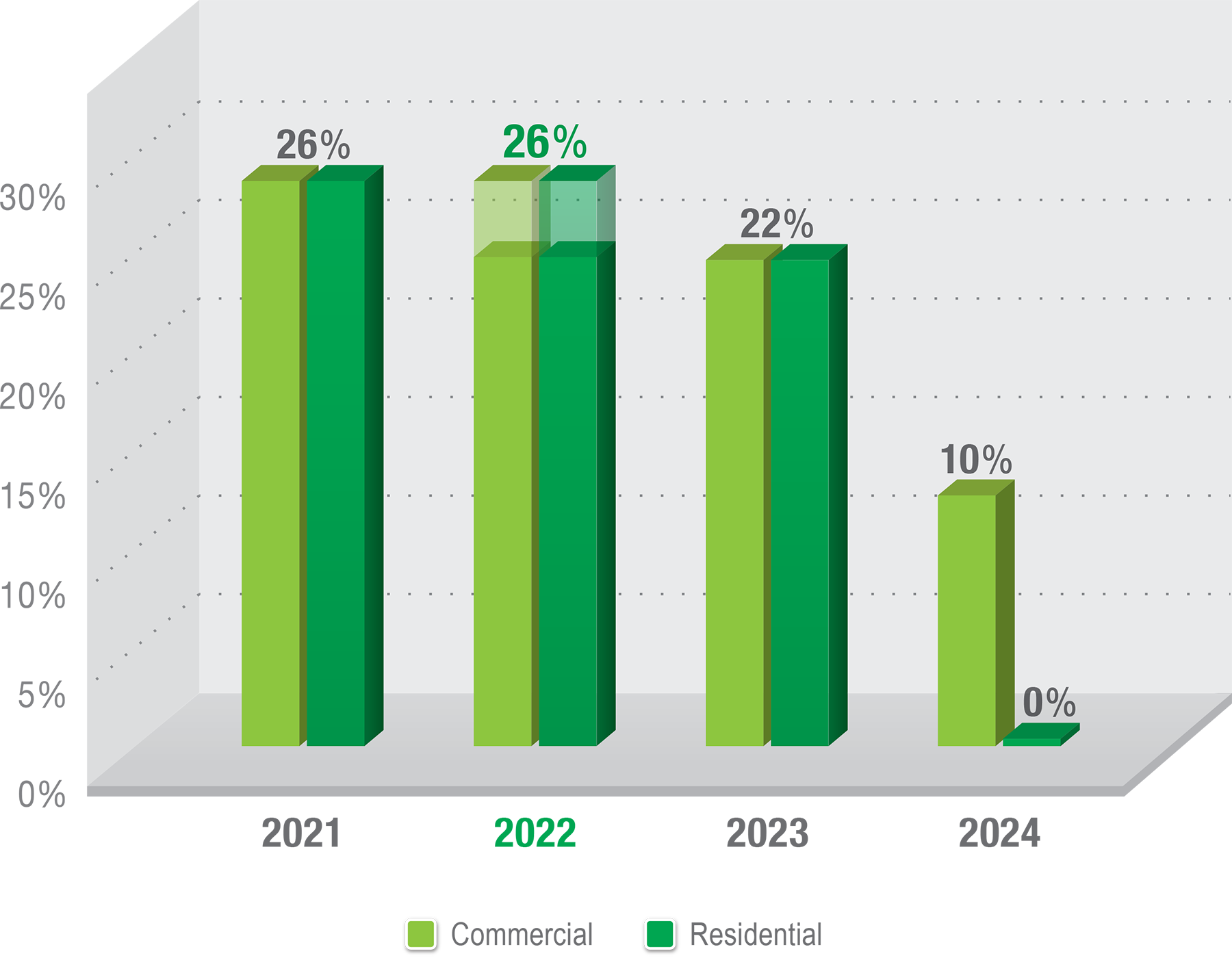

26% Solar Investment Tax Credit Extended Through 2022

The $1.4 trillion federal spending package signed into law at the end of 2020 contained some good news for Americans looking to convert to solar energy. The 26% solar investment tax credit (ITC) that was just a few days away from expiring got extended for another two years. So, any solar installation that begins construction before 2023 will still be eligible for the full 26% tax credit.

Though a lot of folks don’t know about the ITC, it’s one of the most important actions congress has taken to encourage the growth of clean and renewable energy. And you’ll definitely want to factor it in when calculating your return on investment for going solar.

So, what is ITC and how does it work?

A Brief History of Solar Incentives

The ITC was first enacted as part of 2005’s Energy Policy Act. It’s been a major contributor to the over 10,000% growth the solar industry has experienced since, as well as the hundreds of thousands of jobs created and billions of dollars invested in the US economy along the way.

The Energy Policy Act of 2005 granted a 30% tax credit to solar installations but was only in effect for a year. At the end of 2006 it was supposed to expire. The ITC, however, proved to be very popular. So, Congress passed the Tax Relief and Health Care Act in 2006 to extend it another year.

Since then, the ITC has been extended just on the brink of cancellation several times, with a few amendations along the way. One important change was in 2008. A $2,000 cap for residential solar installations that severely limited the ITC’s benefit to homeowners was thankfully removed.

Now the tax credit for residential or commercial solar systems stands at 26% and applies to the full cost of the system with no caps whatsoever.

How It Works

It’s important to realize that the ITC is a tax credit not a payment. That means you get to deduct 26% of the full cost of your solar installation from your tax bill. But the catch is that you have to pay federal income taxes to benefit at all. And you’ll only be able to recoup your full ITC if you pay at least that much in taxes.

The good news, however, is that you can carry over the ITC for up to five years.

How The ITC Works

After filing your taxes for the year your system was installed, you’ll get a 26% tax credit for the following year. If your tax bill winds up being equal to or greater than 26% of the full cost of your installation, that amount will be deducted from your bill. In that case, you’d be recouping the full amount right away. But if 26% of the total cost of your installation turns out to be less than the amount of federal income taxes you owe the next year, the balance can be applied to your future tax bills until its exhausted for up to five years.

The upshot is that the vast majority of homeowners will wind up recouping the full 26% of the total price of their solar installation, usually the very next year. But a small percentage won’t get the ITC’s full benefit. And you’ll want to find out which category you’re in and how much of the full potential refund you can expect to recoup if you wind up falling in the latter category.

Another important caveat is that the 26% solar ITC goes to the owner of the solar installation. So, if you wind up deciding to lease your system from the installer through a solar power purchase agreement (PPA), you won’t be eligible for any refund. You also need to own your home since renters don’t qualify either.

To get your credit, whoever does your taxes will need to file IRS Form 5695.

Reduced ITC Through 2024

But there’s more good news contained in the most recent ITC extension. Though the full 26% tax credit is only available if your solar installation begins before the end of 2022, reduced ITCs are still available through 2024.

- Solar installations that begin construction in 2023 are still eligible for a 22% tax credit on their full cost. That’s a 4% drop from the current rate.

- Those that begin in 2024 are still eligible for a 10% tax credit on full cost. That’s a fairly substantial 16% drop.

Given its history, there’s a good chance some form of ITC will be extended again. But nothing is certain, especially given all the recent upheavals America and the rest of the world have experienced.

So, if you’re thinking about going solar, now is the time to start getting estimates. Remember, the tax credit you’ll be eligible for depends on the year construction starts, not the one in which you sign the contract. And, as things stand, homeowners whose solar installations don’t start till 2024 stand to lose a pretty penny.